Bookkeeping

What is Target Profit and How is it Calculated?

Again, setting the target profit to zero will give the sales break-even point. In above CVP chart, red dot represents break-even sales and blue dot represents target sales. We can observe that the corporation breaks even at a sales volume of $1,120,000 and target sales for the next year are $1,680,000 which are $560,000 higher than the break-even sales. Notice that to get target profit formulas or equations, we have just included the target profit to break-even point formulas.

Financial Statements

It means when the business generates revenue beyond the break-even point, it starts earning profits. The management can set a specific amount as target profit above that break-even point. Target profit analysis is about finding out the estimated business activities to perform to earn a target profit during are campaign contributions tax deductible a certain period of time. Among these activities, management is especially interested to find out the sales volume required to generate a target profit. Target profit is the expected amount of profit that the managers of a business expect to achieve by the end of a designated accounting period.

The Importance of Target Profit in Business

By understanding these cost structures, companies can better manage their resources and optimize their operations. As an illustration, suppose a start up manufacturing business wants to target a profit of 15,000 in its financial projections. Additionally its product sells for 15.00 and costs 6.75 to produce, and it has fixed costs of 60,000. The number of units it needs to sell to reach its profit target is as follows. In addition to its strategic applications, sensitivity analysis also enhances internal decision-making processes.

Target Profit or Revenue

An alternative method is to follow the cost-volume-profit or the CVP approach. Let us discuss this desired profit concept and different methods to calculate it. Target Profit is the estimated amount of profit the management hopes to achieve during an accounting period and is forecasted and updated regularly as per the business’s progress.

- Break-even analysis also aids in evaluating the impact of changes in costs, prices, and sales volumes on profitability.

- Target profit is the expected amount of profit that the managers of a business expect to achieve by the end of a designated accounting period.

- They can decide where to cut expenses or when to invest more in marketing.

- In previous pages of this chapter, we have focused mainly on the break-even point.

Here are a few advantages of using the target profit approach as compared to the arbitrary budgeting method. The first step is to determine the profitability of each product and rank them accordingly. The graphical method of the profit-volume analysis assumes that the company must sell its most profitable product first. The above equation can be used with a little variation of using the C/S ratio instead of the contribution margin. The management can then add the desired profit that comes through excess of the break-even point sales. Since budgets come with inevitable variances, an alternative method is desired.

Future-proof your marketing measurement

A firm grasp of target profit enables businesses to manage their revenue more effectively. They can decide where to cut expenses or when to invest more in marketing. Understanding how to calculate target profit, analyze break-even points, assess sensitivity, and evaluate the impact of sales mix are essential components in this process. One of the helpful uses of CVP analysis is the determination of the sales required to generate a target profit (or desired income). The target profit approach is a useful tool in achieving the financial objectives of the business. The target profit method can be used in a single or multiple-product environment.

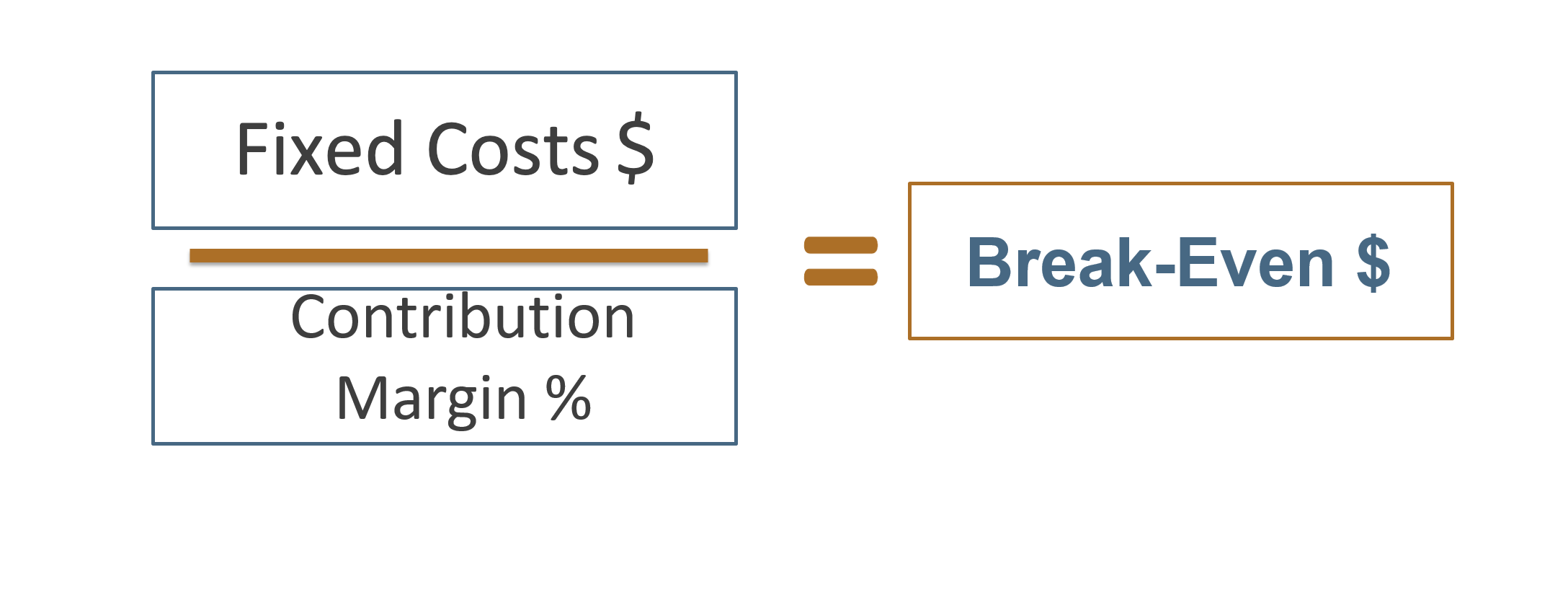

The second step is to draw the graph with the cumulative sales showing on the x-axis and the profit on the y-axis. The methods discussed above are useful for a single-product facility or a manufacturing facility with a limited number of products. However, in many cases, there are several similar products manufactured in the same facility. If it is set to zero in the above equation, it will give the break-even point in terms of sales. However, many businesses fail to achieve it through this approach as they cannot control budgets.

If you compared operating income between two similar companies, such as Lowes, Inc. and The Home Depot, Inc., you would be comparing apples to apples. As mentioned earlier, there are several methods to calculate it for a business. The CVP method is an accurate and widely used method that can be used in single or multiple products scenarios effectively. In the final step, all figures are placed in the following formula to calculate this profit. The choice largely depends on the complexity and nature of the business. Target profit is defined as the expected amount of profit that a business intends to achieve during a specified accounting period.